The term IPO conjures images of empire-making where a hot young company with a great product offers pieces of its future-self for sale to the public as a means of raising money without incurring debt. The money is then used to create the next titan whose new jolt of growth is shared with all who participated.

Today, every annual report to shareholders touts the great team of people whose social, creative, and intellectual capital make it all happen, the worthy and stoic investors whose vision drives sound decisions, and the legions of happy customers who make it all worthwhile.

Essentially, an IPO is people buying into the productivity of other people.

Yet, the IPO is a strict and complex legal and regulatory maneuver that establishes property rights on these small pieces of future productivity – represented by “stock” in the company.

There are underwriters (usually a bank), battalions of lawyers, the securities and exchanges commission (SEC), brokers, insurers, re-insurers, institutional investors, private investors, and retail investors. There is a full infrastructure supporting the facts of incorporation, disclosure, accounting, and proper management of internal “inside” information. And, of course, there is a media /PR campaign. All are integrated to keep the game fair, yet viable.

In the Age of Social Media

I could be wrong but it seems that such vast infrastructure appears a bit awkward if the end result is simply for people to buy into the productivity of other people. This happens everyday in Social Media. At some point, we really need to ask; why can’t an individual or a group of individuals raise money without incurring debt like corporations can?

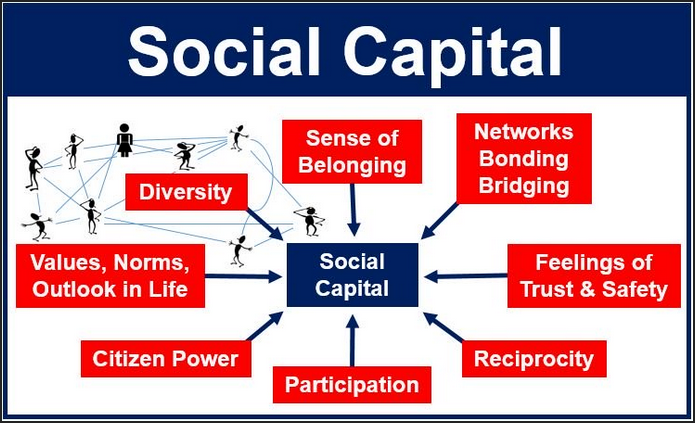

In Social Media, people own and deploy their relationships, communities, motivation, their knowledge, creativity, intellect, mentorship, leadership, teamwork, their network, and even their ability to form corporations – people own their time. Social currency is backed by the scarcity of time and the availability of surplus knowledge.

All of the structural components of the financial system are appearing in an analogous form in social media; social vetting, social gaming, aggregation, influence, knowledge inventories, communities of knowledge assets, local social, global social, tag search, deep search, semantic search, stream of consciousness search, geolocation, mobile computing, multi-media, and many more innovations are being created and deployed everyday which literally serve the functions of banks, lawyers and legislation in an invisible economy.

The Ingenesist Project tries to string this all together with just enough specificity so that an alternate financial system will jump start itself and become both visible and available to everyone.

We’ll hold an IPO for Humanity

All of the infrastructure and the potential for people to produce things would remain intact regardless of what happens to the currency. Think about what would happen if all the dollar based money system evaporated. The only safe haven for the storage and exchange of value will be in people and their communities.

The only thing missing is a system that can articulate social capital, creative capital, and intellectual capital instead of land labor and financial capital. This system can be built today.