Money is supposed to represent human productivity; otherwise nobody would work for it (think about that for a second).

Today, money is created from future productivity in the form of debt; when you take a loan, money is created out of thin air and posted as an asset on the banks ledger. Unfortunately, the money required to pay interest is never created at all, which drives eternal scarcity.

What Happens Next:

Through the miracles of the fractional reserve system and high finance; money gets thrown into a blender where it is then divorced from the productivity of those who create it, and is converted to exotic financial instruments that bet for or against the future productivity of the future productivity of the future productivity, etc – in both Calculus and Finance, these are called derivatives.

Why does it still work?

So the question becomes; if money does not represent productivity, then why do people still work for it? Well, there is no other alternative to money as we know it.

Then came … and went … Bitcoin;

Bitcoin is all the rage because it behaved sort of like a currency – it had many of the desirable characteristics for the storage, exchange, and unit of account for value. But something about it didn’t sit right with society in general – most people aren’t willing to work in exchange for it.

Bitcoin has 3 fatal flaws:

- Bitcoin does not represent human productivity.

- The total available Bitcoins were highly concentrated among a very few people.

- Bitcoin are speculative in value.

Many words have been committed to these topics so I’ll leave a deeper understanding to the reader to research on their own. However, we can now ask the question;

What if a virtual currency could be designed that does represent human productivity, is widely distributed among the users, and empowered by those who interact with it?

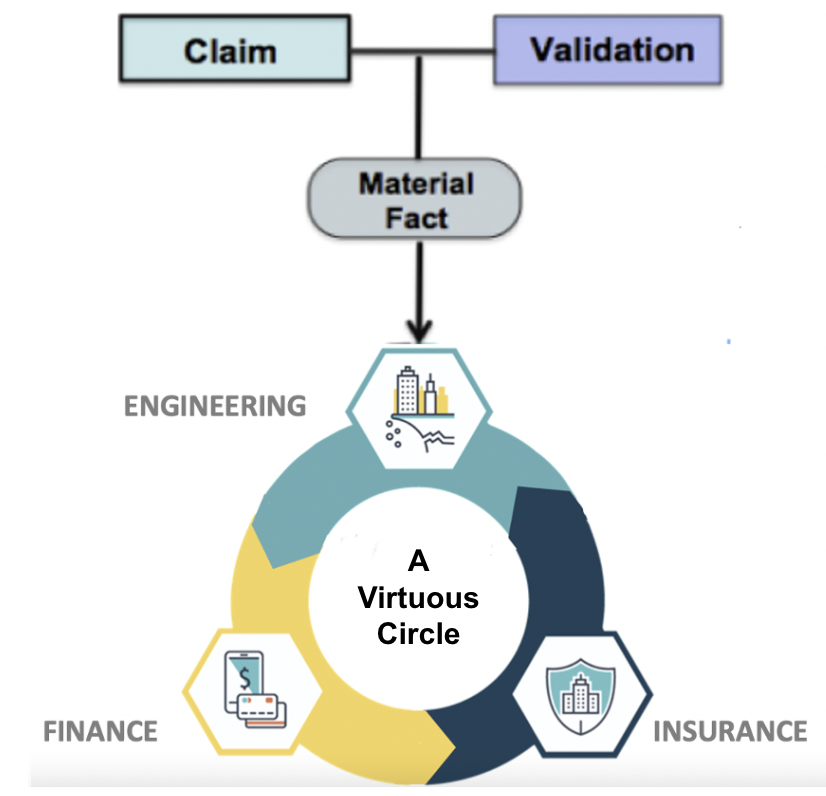

Consider an Engineering Backed Currency:

Let’s consider an engineering backed currency and the existing institution of the National Society of Professional Engineers (NSPE)

Condition 1: Engineering works increase human productivity in the form of roads, bridges, machinery, energy, clean water, sanitation, and generalized problem solving. A currency backed by engineering would invariably be backed by human productivity thereby satisfying condition #1.

Condition 2: Suppose that upon paying their 300 dollar dues to the National Society of Professional Engineers, the NSPE Knowledge Bank issues 3000 NSPE Bucks, a virtual currency, to the member so that any member can trade with any other member for the purposes of learning, teaching, and collaboration (don’t worry yet about the technical challenges of doing this).

If any member gets stuck on a project, or they need to understand new technologies, or are looking for complementary knowledge, they can compensate another engineer in the NSPE Technical Network using NSPE Bucks. Young engineers can teach seniors about new tech, social media, hot mobile apps, and seniors can teach young engineers about nuances of engineering practice, etc., all in exchange for NSPE-Bucks. NSPE bucks will become evenly distributed thereby satisfying condition #2.

Condition 3: The NSPE Bucks act as a form of insurance. If an engineer gets stuck on a project or needs a review of their work or intersects another discipline, they can get rapid and effective support across a vast network of knowledge assets in the profession. An engineer may be empowered to interact with their peers and innovate in their careers knowing that the wisdom and experience of their peers is mutually accessible. As such, condition number 3 is met.

Hold on to your seat – this last point will blow you away:

Innovation is the domain of engineering – the two words are synonymous. People innovate today for the purpose of increasing productivity in the future. Remember, debt is also a currency backed by future productivity. Therefore, when you have two currencies that are backed by the EXACT same underlying asset, they are fully convertible on an open exchange. So NSPE bucks can be easily converted back to dollars or simply traded broadly in a market.

The Mother of All Hedge Funds

As the dollar weakens in scarcity, the NSPE Buck will strengthen in abundance, value will be preserved in the works of engineering that are created. In fact, an engineering backed currency would hedge the dollar as it weaken in it’s ability to maintain infrastructure, build schools, solve climate problems, and provide for the safety health and welfare of people and property.

There is no shortage of work to do and there is no shortage of innovation – there is only a shortage of money. If Banks can print money out of thin air, why can’t engineers?