The World is grasping for an “Easy Pill” to combat global systemic risk. What if such a thing actually existed, would we embrace it?

Imagine if there was a small and almost imperceptible flaw in modern capitalism that could be easily rectified. This single flaw might be the root cause of all the other problems we struggle to solve individually. The remarkable thing is that this flaw could be corrected without dismantling the entrepreneurial spirit, technological advancements, or the functioning institutions that already exist. Moreover, this correction wouldn’t require policy makers and business leaders to fundamentally change their ways.

Would you invest in a team that could address this flaw?

Let’s explore the flaw:

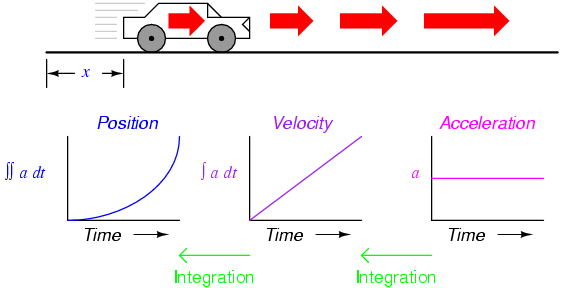

In order for economic growth to occur, technological change must always precede it. However, we currently approach the business of civilization as if economic growth can come before technological change. We have it backwards.

Consider this: the wheel, the wedge, and the lever were invented long before the establishment of international trade agreements. Somewhere along the line, we lost our way. Innovation is not derived from money; instead, money arises from innovation. Although it may seem trivial, this tiny flaw exerts control over almost every aspect of our lives.

Economics did not start with someone discovering $300 trillion in box somewhere. All money came into existence as a measurement of useful things that people have created since the beginning of time. By simply altering how we measure things, we can effect the value and distribution of money. Nowadays, when you ask a venture capitalist to define “innovation,” they might respond with something like, “I know it when I see it.” While this might be a valid measure for them, it holds little value for anyone else. What we truly need is a way to identify and measure innovation before it even happens. Surprisingly, this is a problem that can be easily solved.

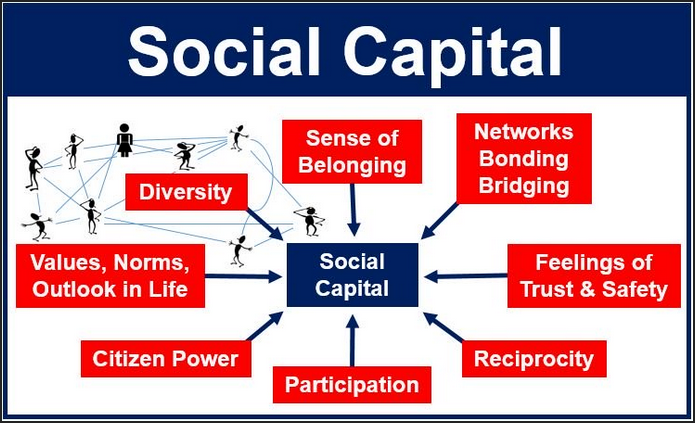

Risk is the common thread that binds us all.

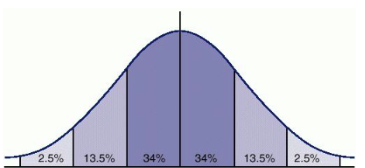

Risk is an inherent part of every decision we make, whether we’re venture capitalists, corporate executives, government policymakers, or members of the general public. In fact, risk heavily influences the premier corporate valuation tool, CAPM (Capital Asset Pricing Model). Risk is the true currency of our lives. For example, the value of a firefighter is determined by the severity of the fires they combat, yet a fire protection engineer can design 1000 buildings that will never burn. Our economy measures the fire itself, rather than the absence of fire.

Engineers exist to mitigate risk in complex systems such as airplanes, wastewater management, and medical procedures. Measuring risk is a relatively straightforward task. The insurance industry, for instance, consolidates various risks into sharing networks and assigns a “value/premium” to expected losses.

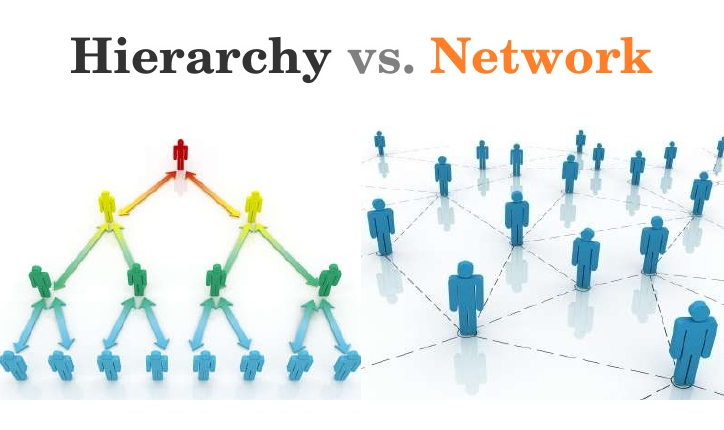

In contrast, engineers are currently organized in disconnected silos, subject to arcane jurisdictions and academic jargon. However, if engineers were organized in networks using a common ontology, similar to how systemic risk itself is structured, an immense amount of value could be measured into existence. This value can then be monetized equitably and on a large scale.

Introducing the Innovation Bank:

The Innovation Bank serves as the mirror image of a traditional bank. Its goal is to organize the engineering, scientific, and technology professions in a slightly different manner. By employing a combination of Game Theory, Blockchain Technology, actuarial math and Artificial Intelligence, the Innovation Bank facilitates the curation of innovation using a common ontology. Nothing else changes. Everything we currently know remains intact. The outcome is the ability to finance the removal of the risks that control us.

This solution is astonishingly simple, defying our imagination. Will we have the courage to embrace it?

The essence of a network lies in connecting people.

We invite you to join The Ingenesist Project. Your knowledge, experience, and creativity are invaluable in building this platform correctly. If you’re pressed for time, you can participate by making a donation of any size.

Please review our partial publication record listed below. We have published at the forefront of our industry, founded numerous start-ups, and our past participants have emerged as prominent voices in the new value movement. The Ingenesist Project has spent two decades maintaining an online presence, representing extensive research and collaboration involving over 120 researchers, engineers, and scientists from some of the most influential corporations and institutions worldwide. Help us unify the global engineering and scientific communities. Help us unite the world.

The value of engineering is perhaps the greatest arbitrage opportunity in history. After 100 years of regulated professional engineering practice, engineering is still valued on a linear time and materials basis. In the Internet age, where everything and everyone is connected by engineering, I argue that the value of engineering may be accounted by the exponential Network Effect.

The value of engineering is perhaps the greatest arbitrage opportunity in history. After 100 years of regulated professional engineering practice, engineering is still valued on a linear time and materials basis. In the Internet age, where everything and everyone is connected by engineering, I argue that the value of engineering may be accounted by the exponential Network Effect. Anyone who was around in the early 1990’s may remember the mantra of modern globalization was that centralized markets were bad and decentralized markets were good. Fast forward to 2016 and blockchain technology: centralized ledgers are bad decentralized ledgers are good. Does this sound familiar? Blockchain and NAFTA may have a lot in common. The good news is that perhaps this new world is not quite as uncharted as it now appears.

Anyone who was around in the early 1990’s may remember the mantra of modern globalization was that centralized markets were bad and decentralized markets were good. Fast forward to 2016 and blockchain technology: centralized ledgers are bad decentralized ledgers are good. Does this sound familiar? Blockchain and NAFTA may have a lot in common. The good news is that perhaps this new world is not quite as uncharted as it now appears.

Are blockchains insurable? This question was posed to us as a topic for presentation by the Center of Insurance Policy and Research, a research arm of the National Association of Insurance Commissioners (CIPR / NAIC)

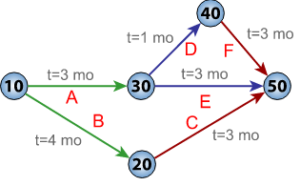

Are blockchains insurable? This question was posed to us as a topic for presentation by the Center of Insurance Policy and Research, a research arm of the National Association of Insurance Commissioners (CIPR / NAIC) On a critical path.

On a critical path.

The hallmark of a great society is the ability to capitalize it’s needs, not it’s arbitrage opportunities. The Highest and Best Use for Blockchain Technology must be to reduce the cost of capital by decentralizing risk, not necessarily money…yet

The hallmark of a great society is the ability to capitalize it’s needs, not it’s arbitrage opportunities. The Highest and Best Use for Blockchain Technology must be to reduce the cost of capital by decentralizing risk, not necessarily money…yet