Modern platforms such as Google, Facebook, AirBnB, and others enjoy astronomical market valuations despite having comparatively less hard assets as legacy firms like Marriot, Boeing, T-Mobile, or Walmart. The difference may have something to do with their organizational structure.

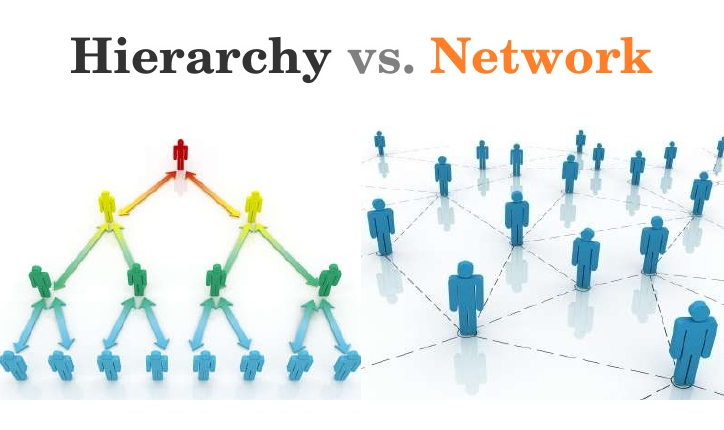

Hierarchy: Since the dawn of the industrial revolution, centralized organizations comprised of multiple levels of management have been the proven means for allocating resources and minimizing risk. The value of such a construct is expressed in terms of market demand and sensitivity to risk as expressed by the Capital Asset Pricing Model (CAPM).

E(Ri) = Rf + Bi (E(Rm)-Rf)

Where:

E(Ri) = Expected rate of return on capital amount

Rf = Risk free rate of return

Bi = Sensitivity to market volatility

(E(Rm) = Expected market return

The CAPM valuation model for an organization is dominated by market risk multiplied by a firms sensitivity to market risk. CAPM valuations are limited by market expectations and performance. CAPM is largely a linear function except in the exclusive state where volatility is very low and market returns are very high, such as monopoly or some duopoly conditions.

Networks: A network is characterized by a collection of nodes (which may represent a switch, a computer, a sensor, or a person) and branches (wires, signals, instructions, or communications) connecting the nodes. The value of networks is a function of the total number of nodes and the total number of possible connections that can be completed between them multiplied by some coefficient of value for the quality of those connections.

Metcalfe’s law for Networks suggests that the theoretical value of a network will be proportional to the square of the number of nodes according to the following relationship.

Theoretical value is proportional to: n(n-1)/2

The Actual value would be related to the quality of the nodes, the actual number of existing branches, and the net quality for the transactions that transpire over the network. For example, the Value of Facebook is estimated at:

VFacebook = (5.70 x 10-9) x n2

Where (n2) is the total number of users and (5.70 x 10-9), is an incredibly small number represents the average quantity and quality of nodes and branches between them. The Facebook platform objective is to maximize total number of connects AND maximize quantity AND quality of the interactions. For reference; MySpace still has 500M registered users giving it a valuable network, however, a low coefficient of interaction has eroded value of the platform substantially.

Self-regulation, fault-tolerance, and Management Autonomy

The network can make independent decisions: An engineer that is mis-allocated can quickly move closer to their area of interest and competence. Overlap between civil, mechanical, and electrical engineers can be managed appropriately. A corrupt engineer would have a very difficult time gaining access to a target without enduring a long and difficult road to establishing a transaction record that would permit sufficient isolation to the target to actually profit from the crime. It would be difficult to corrupt an engineer without knowing if they will be assigned to a target. It would be difficult to which engineer will be assigned to a potential target in advance of the attack. If an attack was attempted, it would be easy to identify who committed the crime. High impact targets may be covered with redundancy or a Byzantine proof. Obviously, Bots would be quickly and easily dispatched to the null condition.

Network Learning

Interactions between nodes will tend to optimize claims such that the value of the compensation received is proportional to the effort required to establish and verify a claim. This is a common practice in professional societies and certification bodies today. Further, strong professional communities with sufficient diversity, create conditions for rapidly and iterative teaching, learning, and collaboration leading to a high rates of innovation. Finally, professionals may reflect artistic or literary expertise or cite membership in multiple networks on their own valuation and the valuation of their team. Reflecting diverse interests from professional, recreational, and social opportunities will increase the individuals stake in the network and everyone’s stake in a team.

The Value of the Quantchain Network:

Economist Robert Solow received a nobel prize for his work in estimating that 80% of economic growth can be attributed to technological change. Said another way, for every 2 dollars spent on engineering, society can expect 8 dollars returned to the economy. This conveniently provided an average nodal value for engineers.

It is easy to count the number of engineers on the Quantchain, therefore the only variable left is the ability to assess the value and diversity of the interactions. Quantchain accomplishes this precise objective in several ways:

- The decentralization of engineers diversifies interactions

- Dominant game strategy = cultivate a diverse community of claimants and validators approaching Dunbar Number.

- The Percentile Search Engine assigns optimum probability vs. cost to all transactions.

- Individual transactions and collective transactions are readily analyzed.

Engineering networks can be assembled and subdivided in any number of ways and theoretical values may be assigned to them making the valuation of teams, mergers of teams, divestiture of teams, or scenario testing of any imaginable combination of teams, a quick and accurate projection of network value.